Product update

A Friendly Tour of the FinToolSuite Compound Interest Calculator

Our free tool is here so you do not have to wrestle with spreadsheets. Enter a few numbers, see how your money could grow, and swap scenarios without any jargon getting in the way.

Published: November 20, 2025 · Updated: December 21, 2025 · By FinToolSuite Editorial

Key Features of the Calculator

These are the parts people tell us they use the most when planning savings goals, testing investment ideas, or simply getting a clearer view of their balance over time.

1️⃣ Instant Future Value Calculation

Add your starting amount, interest rate, and time period. The moment you hit enter, the calculator shows how your balance could grow.

2️⃣ Support for Regular Deposits

Want to invest monthly or weekly? Add your contribution amount and frequency. The calculator updates compounding and shows how deposits speed things up.

Perfect for: monthly savings plans, investment SIPs, and long-term saving habits.

3️⃣ Flexible Compounding Frequencies

Choose how often interest compounds: yearly, semi-annual, quarterly, monthly, or weekly. More frequent compounding usually means faster growth, so you can see the tradeoffs right away.

4️⃣ Detailed Year-by-Year Breakdown

See exactly how your balance changes each period. This helps you understand how much interest you earn, how contributions add up, and how your money grows in stages.

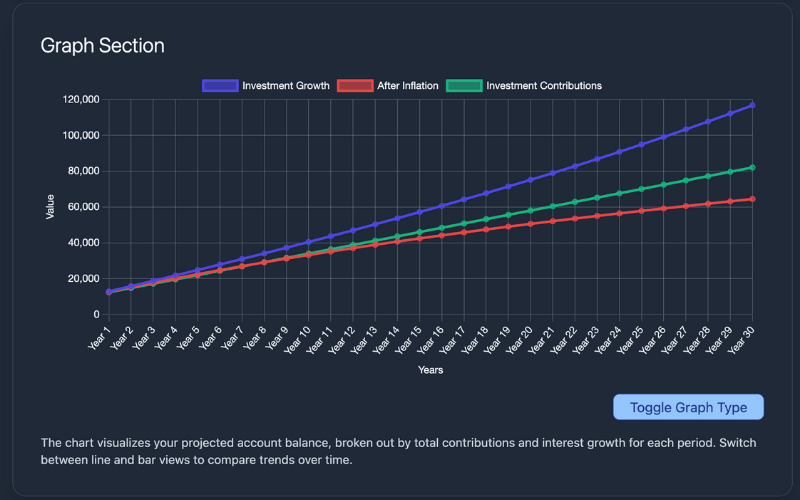

5️⃣ Charts and Visual Growth Graph

Visual graphs help you compare growth with deposits, without deposits, and how much interest versus principal makes up the final balance.

6️⃣ Withdrawals & Custom Scenarios

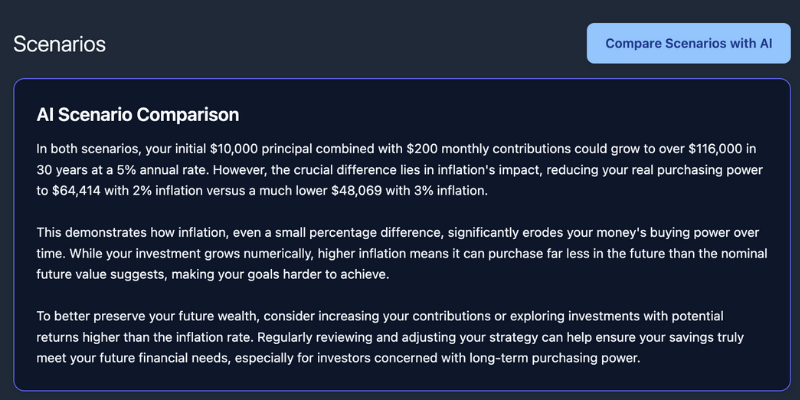

Simulate annual withdrawals, percentage withdrawals, or retirement-style drawdowns. It is useful for saving plans and for mapping how long a pot might last if you need to draw from it.

7️⃣ Works With Any Currency

The tool adapts to whatever currency you enter — no limitations.

Why Our Calculator Stands Out

This calculator is built to be accurate, intuitive, and comfortable for beginners. The design stays out of the way while still giving you the detail you need.

- Clean and simple design

- Real-time results

- No login needed

- Mobile-friendly

- Powerful enough for detailed financial planning

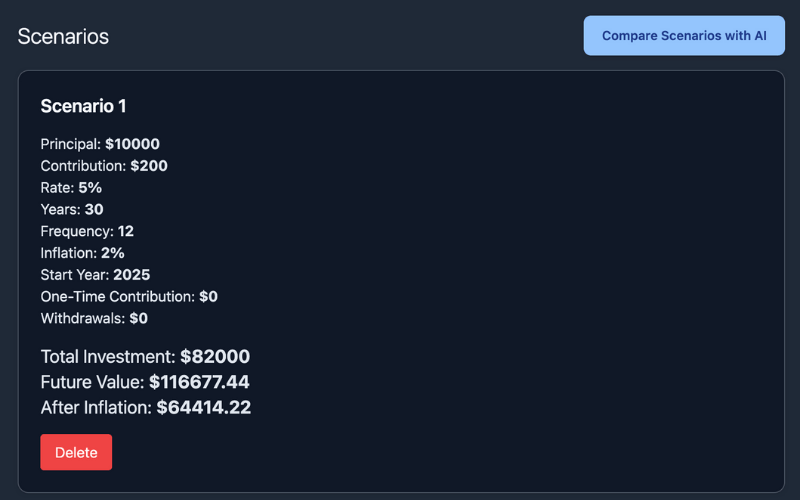

Example: How Fast Can Your Money Grow?

Here is a quick scenario you can mirror:

- £5,000 starting balance

- 6% interest rate

- 10-year horizon

- £100 monthly deposit

The calculator instantly shows total balance, total interest, how much you contributed, and how much came from compounding. It is a quick way to picture long-term growth without manual math.

Tips to Maximize Compound Growth

- Start early: time is the strongest multiplier.

- Contribute consistently: even small monthly deposits add up.

- Pick realistic compounding: match the frequency to how your account pays.

- Delay withdrawals: give your interest more time to work.

- Step up over time: adding £10–£20 more each month can close gaps quickly.

Try the Compound Interest Calculator Today

Whether you are saving for a home, retirement, school, or investing for the long term, this calculator helps you make steady, informed choices. Scroll up, enter your numbers, and see what happens when you tweak deposits, time, or rates.

Open the calculatorQ & A

Does this calculator store my inputs?

No. Inputs stay in your browser unless you export or choose to share the results.

Can I model both deposits and withdrawals?

Yes. Add recurring contributions and test fixed or percentage withdrawals to see saving and drawdown side by side.

Which compounding frequency should I pick?

Match the frequency to how your account credits interest. Monthly is common and usually grows faster than annual schedules.

Will currency symbols affect the math?

No. Currency symbols are for display; calculations use the numeric amounts you enter.

Can I export the results?

Yes. Export CSV or PDF to share charts, tables, and AI insights.

About the Author

Alex Warren is a financial content writer specializing in savings tools, investment calculators, and personal finance education. He creates easy-to-understand guides that help readers make smarter money decisions using clear data and practical examples.